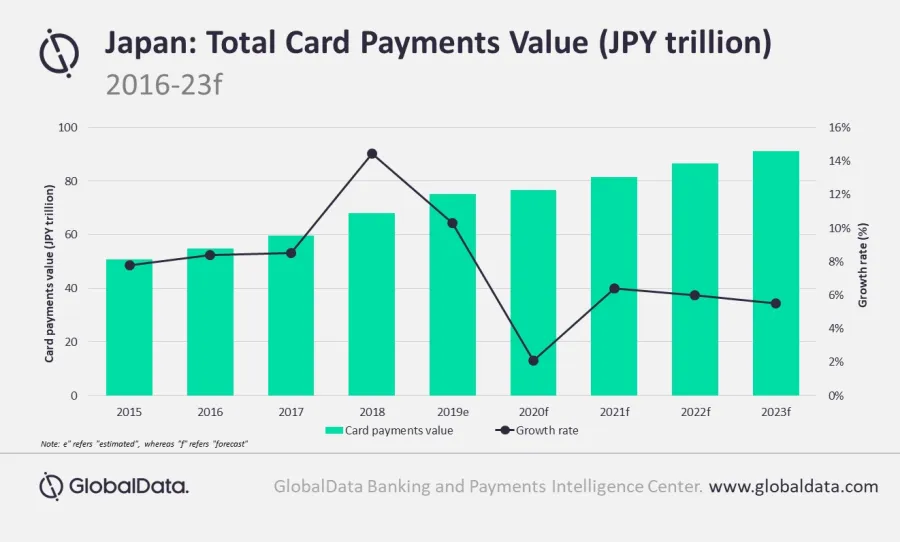

Chart of the Week: Japan card payments to grow 2.1% in 2020

Pandemic-related fears is crippling away at cash payment’s dominance.

The value of card payments in Japan is estimated to grow by 2.1% in 2020, reports data and analytics company GlobalData. The value is expected to reach $839.4b (JPY91.2t) by 2023, growing at a compound annual growth rate (CAGR) of 6% between 2020 and 2023.

Cash remains king in Japan, where it accounts for 73.3% of the overall payment volume in 2019. However, fears of spreading the COVID-19 virus through cash transactions will likely push up card and e-payments growth, says Ravi Sharma, banking and payments analyst at GlobalData.

“The frequency of card payments remains low in Japan at just 0.8 transactions per card per year in 2019, which is mostly due to the country’s traditional preference for cash transactions. However, the fears of COVID-19 spread through cash handing and growing preference for electronic payments are likely to push payment cards use,” noted.

“Whilst cash will continue to be the dominant payment mode, expanding payment infrastructure, rising card acceptance among SMEs, and the growing consumer preference for non-cash transactions due to COVID-19 will accelerate the adoption of electronic payments over the next five years,”

More retailers are also changing their payments infrastructure to accept contactless payment as a mode of payment. Just this June, popular retailer 7-11 Japan made contactless card acceptance available at all its stores in the country. This allowed shoppers to use contactless payment with debit, credit and prepaid cards from major brands–Visa, Mastercard, JCB, American Express and Diners Club.

Cards issuers are also making payment settlement process faster for card accepting merchants by encouraging them to accept more card transactions. In July, Sumitomo Mitsui Card introduced faster payment cycle for its merchants, allowing them to receive the proceeds from their sales made via credit cards within just five days compared to a month or more in the past.

Advertise

Advertise