Chart of the Week: Health and safety concerns drive card payments growth in New Zealand

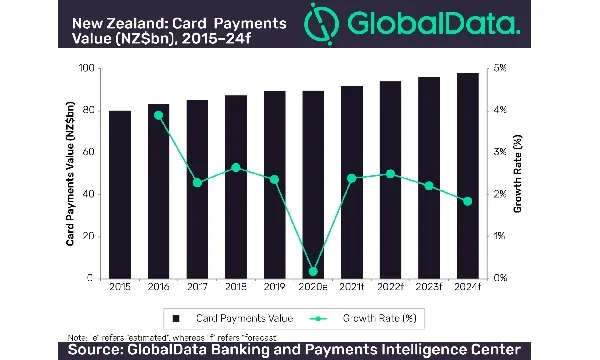

Card payments are expected to rise at a CAGR of 1.8% to $66b by 2024.

Card payments in New Zealand will continue to rise at the expense of cash amidst the coronavirus outbreak, though at a slower pace, according to a report by GlobalData. Forecasts reveal that card payments in the country will likely rise at a compound annual growth rate (CAGR) of 1.8% from $60.3b in 2019 to $66b by 2024.

The present crisis in particular is driving e-commerce growth, as individuals move to avoid exposure to the virus by shopping in the comfort, safety, and convenience of their homes—which in turn benefits the card payments market, according to GlobalData’s banking and payments analyst Nikhil Reddy.

“The pandemic will have a profound effect on consumer spending, affecting the payments industry. It has triggered a fear of infection through handling of cash, thus pushing adoption of non-cash payment tools, particularly contactless cards,” he noted.

With an aim to reduce the need for consumers to touch PIN pads whilst making in-store purchases, the limit for contactless payment in New Zealand had been temporarily increased from US$53.96 (NZ$80) to US$134.89 (NZ$200), effective from 9 April.

Credit and debit cards together already accounted for over half of the country’s total e-commerce payments value in 2019, according to a report by GlobalData.

“New Zealand has a well-developed card payments market. Although the pandemic is set to hamper payments industry growth in the short run, the rise in consumer spending once the restrictions are lifted coupled with the growing consumer preference for electronic payments will fuel growth in the country’s payments card market over the next five years,” Reddy concluded.

Advertise

Advertise