Chart of the Week: COVID-19 to drive digital payments take-up in Hong Kong

E-payments firm Octopus said that mobile wallet usage rose 30% in February.

Pandemic-stricken Hong Kong consumers are increasingly taking up mobile wallet solutions for in-store payments as they seek ‘safer’ alternatives to paying for their purchases, a caution brought about by the COVID-19 pandemic, reports data and analytics firm GlobalData.

Consumers are switching from in-store to online purchases in order to avoid exposing themselves to disease vectors such as cash and POS terminals, noted GlobalData. For example, Hong Kong-based e-commerce platform HKTVmall reported a 165% increase in the number of orders in February 2020 compared to the same month in 2019.

The shift in payment attitudes is also reflected in the increase of use of mobile wallets, as these solutions are arguably ‘safer’ due to the lack of physical contact with foreign objects. Electronic payments firm Octopus announced that its mobile wallet usage increased by 20% and 30% in January and February, respectively.

“The pandemic has resulted in a shift in consumer spending behavior, as wary customers will cut down on purchases of non-essential items, thereby resulting in overall decline in consumer spending which in turn is set to affect the payments growth,” noted Nikhil Reddy, banking and payments analyst at GlobalData.

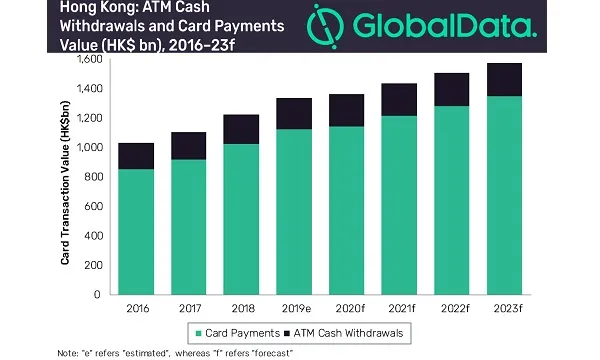

Both ATM card withdrawals and card payments in Hong Kong are set to grow at a more subdued pace through 2023. Revised forecasts predict that the ATM cash withdrawals value will grow at a subdued compound annual growth rate (CAGR) of 1.2% between 2019 and 2023.

Similarly, card payments value will rise at a CAGR of 4.7% during the same period, a slower pace than the previous estimates.

“Though the pandemic will cause a short-term impact on payment volumes, it is expected to bring a change in consumer payment behavior by driving the adoption of electronic payment, particularly non-contact tools such as contactless cards and mobile wallets at an expense of cash,” concluded Reddy.

Advertise

Advertise