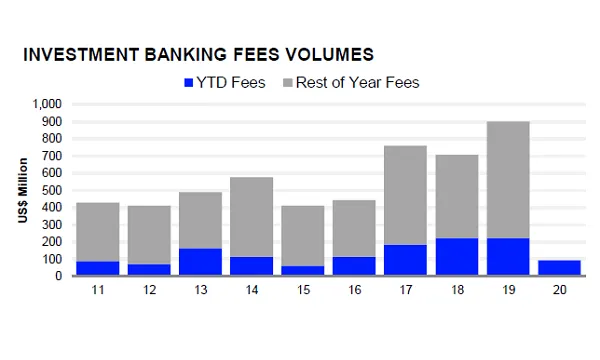

Singapore's investment banking fee revenue down 58.7% to $91.9 in Q1

Advisory fees for M&A deals plunged 80.4% YoY to $11m.

The value of Singapore’s investment banking activities plunged 58.7% YoY in Q1, totalling $91.9m, according to data from research firm Refinitiv.

Revenue from advisory fees for completed mergers and acquisitions (M&A) were the hardest hit, plummeting 80.4% YoY to $11m.

Overall M&A activity reached $25.65b (US$17.6b), down 35.7% YoY after a strong start in 2019. Singapore-targeted M&A activity crashed 33.8% YoY to $11.1b, whilst domestic M&A amounted to $9.1b and fell 10.8% in value. Meanwhile, cross-border M&A activity slowed down as inbound M&A activity fell 69.2% YoY to $2b, whilst outbound M&A dropped 31% YoY to $4.8b.

The biggest M&A deal so far is the proposed merger between CapitaLand Mall Trust and CapitaLand Commercial Trust for $8b.

Refinitiv noted that the majority of the M&A deal making in Singapore targeted the real estate sector, accounting for 64% market share and totaled $11.2b. However, this figure is 15.4% YoY lower compared to Q1 2019. Financials took second place with a 7.4% market share, followed by high technology at 6.1%.

Deloitte leads in the M&A league table rankings as it accounts for 50.4% market share at $8.9b in deal value.

All other asset classes recorded declines. Underwriting fees from the equity capital market (ECM) were halved (54.7% YoY) to $29m over the same period.

ECM issuance plunged 64.5% YoY to $804.2m so far in Q1, its lowest start to a year since 2017 according to Refinitiv. Follow-on offerings fell 91.2% YoY to $191.7m worth of proceeds.

Lastly, debt capital market (DCM) underwriting fees similarly plunged 60.4% YoY to $22.3m. Syndicated lending fees also slowed down 35.8% YoY to $29.6m.

Primary bond offerings from Singapore-domiciled issuers were nearly halved (45.2% YoY) in Q1 to $4.3b. Singaporean companies in the financial sector captured 50.8% market share but 27.7% lower to $2.2b YoY.

DBS Group currently leads the Singapore bonds underwriting with $1.7b of proceeds and capturing 38.8% of the market share. The bank also takes the lead in the overall investment banking fees with a total of $13.8m or 15.2% of the total fee pool.

In contrast, the value of initial public offerings (IPOs) rose eight-fold in Q1 to $612.5m. Elite Commercial REIT’s $170.5m IPO is currently the largest IPO deal in Singapore. Credit Suisse currently leads Singapore’s ECM underwriting rankings, with a 21.1% market share and $155.3m in related proceeds.

Advertise

Advertise