Chart of the Week: Wealth and retail drive 60% of Singapore banks' fee income

DBS and OCBC’s private wealth AUM grew 15% CAGR in the past 6 years.

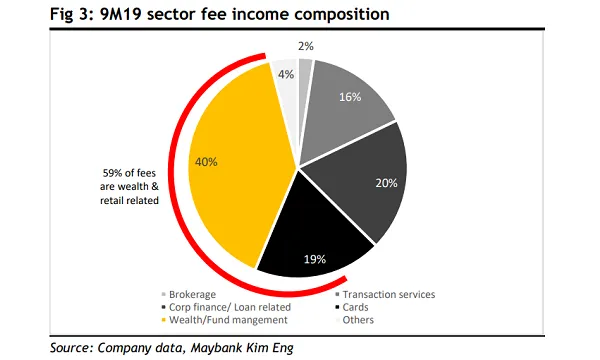

Almost 60% of Singapore banks’ fee income in the first nine months of 2019 originated from wealth and retail segments, according to a report by Maybank Kim Eng.

“Ten years ago, trading and investment securities contributed over half of non-interest income (NI) for Singapore banks. By 9M19, this shrunk to 44%, with rising fee income taking its place,” said Maybank analyst Thilan Wickramasinghe.

These segments are also believed to drive fee growth in the medium term.

One determining factor for this will be the strengthening of private banking franchises amongst the local banks. “Singapore’s strong banking regulations, stable macro will continue to attract private banking assets under management (AUM) from the region as well as other offshore hubs, in our view,” noted Wickramasignhe.

Private wealth AUM for DBS and OCBC has also grown at a 15% CAGR in the past 6 years, the report added.

DBS, in particular, has given importance to the segment with their plan to grow AUM by 7-8% annually to $221.35b (S$300b) until 2023. Similarly, OCBC and UOB are expanding their wealth offerings regionally.

Expansion targets for DBS include Indonesia whilst also continuing to strengthen their North Asian presence. In Thailand, DBS plans to double AUM to $5.9b (S$8b) by 2023 together with joint offering from DBS Vickers Securities.

Meanwhile, OCBC is expanding private wealth in Malaysia, Middle East and Europe through their Bank of Singapore franchise.

Wickramasignhe noted that overseas lending for private banking transactions, such as overseas property purchases is picking up (ACU consumer loans +9% YoY in October). “These activities together with higher yield seeking, and a hunt for safe havens from volatility in HK, and other macro uncertainties should continue to drive wealth management/retail fees forward in 2020E,” he added.

Advertise

Advertise