Singapore fintechs nab 51% of funding in ASEAN as of Q3

Singapore Life’s $150.39m funding was amongst the year’s notable deals.

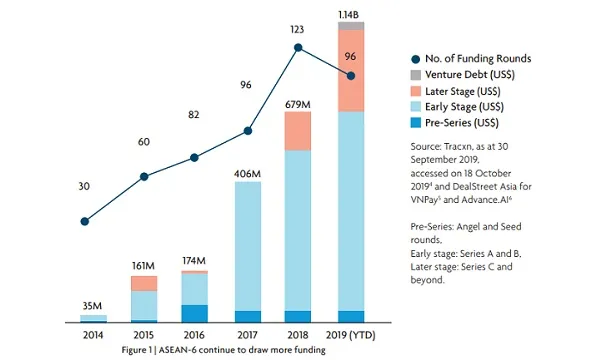

Singapore’s financial technology (fintech) firms attracted the lion’s share of fintech funding in Southeast Asia, or 51% of the $1.55b (US$1.14b) funds garnered by the region’s countries by the end of Q3 2019, a report by United Overseas Bank (UOB), accounting firm PwC, and Singapore Fintech Association (SFA) revealed.

Singapore also attracted the lion’s share of the total number of funding deals in the region, at 51%.

Chief amongst the Singapore deals that took place in 2019 was Singapore Life’s series C funding round, which garnered $150.39m (US$110.3m). It was also the second-highest funded fintech transaction so far, trailing the $409.04m (US$300m) investment received by Vietnam’s VNPay.

Funding for Singapore-based fintech firms was the most evenly distributed, with insurance technology (28%), banking technology (23%), payments (13%), and personal finance (14%) leading the way.

“Singapore had the most variety in terms of solutions focus, [a] testament to the country’s push to encourage FinTech innovation across a broad range of areas. The highest number of deals were made with firms offering payment solutions, while the highest amount of funding went to InsurTech solutions, driven by two deals, specifically Singapore Life at $150.39m and CXA Group at $34.09m (US$25m),” the report read.

Singapore also emerged as the number one choice of fintech firms entering ASEAN, according to the inaugural “FinTech in ASEAN Growth Survey 2019.”

The survey found that amongst non-ASEAN fintech firms who plan to expand to the region, 26% chose the Lion City as the preferred market for their foray into ASEAN. Malaysia and Thailand followed, with 18% and 17% of fintech firms choosing the two countries.

Advertise

Advertise