Australian contactless cards to hit nearly 70 billion by 2023 as cash loses luster

The number grew at a CAGR of 12.7% from 2015-19.

The number of contactless cards in Australia is expected to continue growing from 59.6 million in 2019 to 68.9 million by 2023 as consumers embrace the payment option at retailers, restaurants and events, according to data and analytics company GlobalData.

The number of contactless cards grew at a compound annual growth rate (CAGR) of 12.7% during 2015-19.

Also read: Cards are chipping away at cash and cheque use in Australia

Contactless awareness is extremely high in Australia, with only 13% of consumers claiming to have never heard of contactless cards, according to GlobalData’s 2019 Banking and Payments Survey. The technology is also being adopted following the introduction of contactless payments for ferry and light rail services in Sydney in March 2018. The service was later extended to Sydney trains in November 2018 and made available on city’s buses in July 2019.

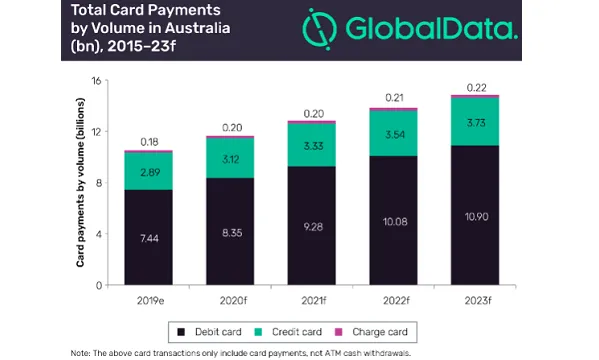

The increasing adoption of contactless cards encourages Australians to switch away from cash, especially for lower-value transactions. Overall, the number of card payments in the country grew significantly from 6.6 billion in 2015 to 10.5 billion in 2019, and are expected to hit 14.9 billion in 2023. On the other hand, the share of cash in the overall payments volume is also expected to drop from 36.5% in 2019 to 24.4% in 2023.

The growing popularity of contactless has also encouraged payment industry participants to adopt new point-of-sale (POS) terminals. In August 2018, Australia Post rolled out smart POS terminals across its 3,600 post offices, allowing customers to make contactless payments using wearables and mobile devices.

Previously, contactless payments could only be routed via Visa or Mastercard, as EFTPOS did not offer contactless functionality. Major acquirers, including Westpac, ANZ and Commonwealth Bank Australia have made this functionality available for their merchants in 2019, a move that will further encourage contactless payment acceptance.

Advertise

Advertise