Here's where online micro consumer lending in Asia flourishes

Southeast Asia’s only landlocked country looks promising for online lending.

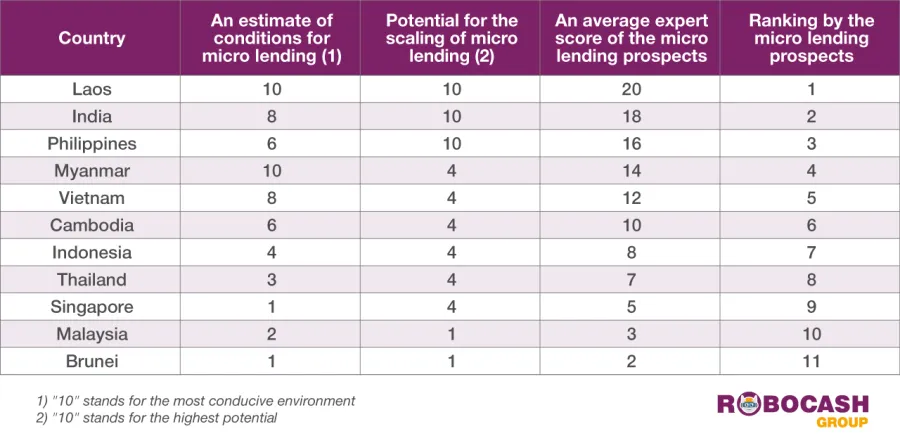

With a high demand potential and a positive attitude to short-term lending, Laos emerged as the most promising market for online micro consumer lending, according to a Robocash study.

Also read: Here's where alternate lending thrives in Asia

The prospects of short-term lending are positive especially as the economy is tipped to grow by 6.7% in 2020 and is currently ranked 119th based on purchasing power parity (PPP) per capita. Despite an underdeveloped legislation and less than half of the population (29.1%) having access to credit products, Robocash believes that foreign companies can play a role in developing the consumer lending market in Laos.

India was the second-highest (18). Among the top five countries, it has the most number of people with access to credit products (79.9%) and the highest 2020 GDP growth prediction (7.4%). Additionally, Robocash noted that not too many foreign companies and Chinese startups have entered the market, which keeps competition quite moderate.

The Philippines landed third at 16. A high urban population (45%), an established market of short-term lending services and flexible regulation give the archipelago an advantage. The government’s push for digitisation of financial services will hopefully include more people in the financial system and give the country a regional edge.

Myanmar is fourth with 14 points. Even with a high GDP forecast for 2020 (6.9%, second only to India’s), underdevelopment, illegal creditors and a large urban population under the poverty line are preventing the Burmese market from attracting foreign investors.

Vietnam took fifth place (12). The online lending industry can thrive in the market due to a significant demand and one-third of the population with credit products. However, Vietnam should improve its regulation on licencing of companies and financial statements, Robocash noted.

Cambodia (10), Indonesia (8), Thailand (7), Singapore (5), Malaysia (3) and Brunei (2) made up the bottom half of the list.

Photo courtesy of Robocash.

Advertise

Advertise