Singapore bank loans reverse slowdown in August

Loans grew 1% MoM and 5.1% YoY amidst steady expansion in business loans.

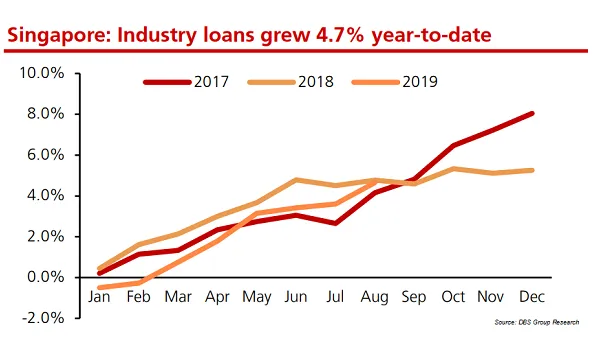

Bank loans in Singapore reversed the slowdown seen in July after expanding by 1% MoM and 5.1% YoY in August, according to DBS Group Research. On a year-to-date basis, industry loans grew 4.7% in the first eight months of the year.

Also read: Regional credit growth props up bank loans as domestic lending falls flat

Business loans drove lending gains in August after growing 1.4% MoM and 7.5% YoY, particularly from building and construction (1.0% MoM and 6.1% YoY), and financial institutions (3.7% MoM and 11.3% YoY), which was largely attributed to ACU. "We believe these two industries will continue to drive loan growth in FY19," analyst Rui Wen Lim said in a report.

Also read: Banks turn to corporates for loan boost as mortgages weaken

On the other hand, loans to the consumer front shrunk with domestic mortgages shrinking for the seventh straight month, down 0.2% MoM and 1.4% YTD.

"We believe the key to mortgage book lies in secondary market transactions, which in 2Q19 recovered from 1Q19’s volumes by +27.6% q-o-q. We believe this should support the decline in mortgage loan book and do not expect the mortgage book to contract severely, unless there is an accelerated slowdown in the economy with massive unemployment," Lim said.

Amidst growing deposit base, loan-to-deposit (LDR) ratio continued to moderate. Deposit growth hit 0.9% MoM and 8.1% YoY to outpace loan growth as fixed deposit demand remained high even as fixed deposit interest rates have come off the peak.

An earlier report from Fitch Solutions notes that year-end bank loan growth may slow to 0.5% as the slowing housing market takes a heavy toll on the banking sector.

Advertise

Advertise