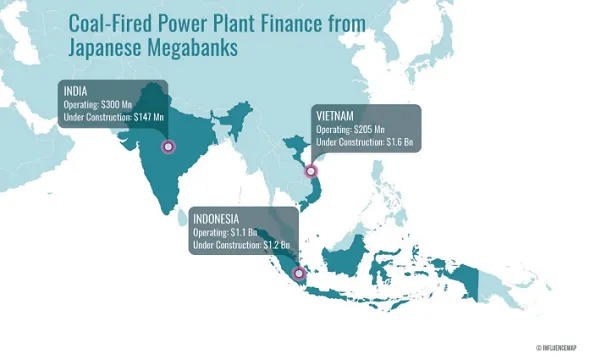

$5b of Japanese megabank loans flow into Asian coal projects

Majority of the loans are financing coal projects in India, Indonesia and Vietnam.

Japan’s three largest private sector lenders, Mitsubishi UFJ Financial Group (MUFJ), Mizuho Financial Group and Sumitomo Mitsui Financial Group (SMBC), have about $5b of outstanding loans for coal power project finance in emerging markets, with the majority in three countries: India, Indonesia and Vietnam, according London-based think tank InfluenceMap.

InfluenceMap’s briefing noted that all loans are anchored with Japanese government loans via the Japan Bank for International Cooperation (JBIC) and guaranteed by Nippon Export and Investment Insurance (NEXI). “The banks’ full lending exposure to coal power is likely much higher through exposure to corporate loans, for which disclosure is poor,” it said.

Japanese investors including Mitsubishi Corporation, Marubeni Corporation and Mitsui Corporation also have equity stakes in 18 projects in emerging markets, with a major stake (30% equity or greater) in at least 10 of these projects. Disclosure of equity holdings is also limited.

InfluenceMap noted that this equity is likely at risk given the uncertain status of coal power in the Asian energy mix in the medium to long term due to competitive pressures from alternative energy sources and strengthened environmental regulations, all of which could render the plants economically unviable.

The briefing cited an analysis from think tank Carbon Tracker Initiative, which suggests that the potential value of stranded coal power assets as their economic viability is undercut by the plummeting cost of renewable energy represents a significant portion of the GDP of the recipient countries highlighted in this report - roughly 3% each in the case of India, Indonesia and Vietnam.

“As the physical impacts of climate change accelerate and public and political concern grows, there is a mounting possibility that future disruption in the recipient-country power markets may lead governments to alter the conditions of their Japanese government-backed loans,” InfluenceMap noted, adding that the guarantee of these loans by the Japanese government for losses related to climate change has yet to be tested.

Advertise

Advertise