Internet-only banks threaten to wipe out Taiwanese bank earnings

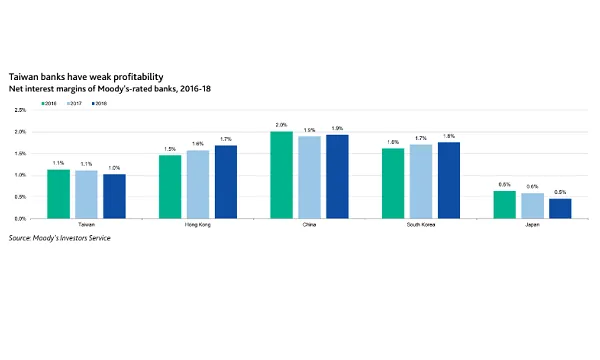

Lenders already have margins that fall behind that of Hong Kong, China and South Korea.

The looming arrival of internet-only banks with big-time backers is expected to heap further pressure on Taiwanese bank margins especially as the sector already grapples with weak profitability, according to a report from Moody's.

Also read: Trade tensions cut Taiwanese 2019 bank loan growth to 3.2%

On July 30, the Financial Supervisory Commission (FSC) granted approval to three consortiums that plan to set up internet-only banks that would begin operations early next year especially as the digitisation efforts of Taiwanese banks have traditionally fallen behind that of their Asia-Pacific counterparts, as a report from S&P suggests.

The FSC requires these new banks to have an initial capitalisation of $317.58m (TWD10b) and operate with a leverage ratio comparable to the 7% average of Taiwanese banks.

One internet-only contender is Next Bank, whose owners include Chunghwa Telecom and Mega Financial Holdings. The second player is LINE Bank, whose ownership consortium includes Line Financial Taiwan Corp. and four banks including Standard Chartered Bank Taiwan Ltd., Taipei Fubon Commercial Bank Co. Ltd, CTBC Bank Co and Union Bank of Taiwan and the third is Rakuten International Commercial Bank, whose owners include Japanese e-commerce company Rakuten, Inc.'s Rakuten Bank, Rakuten Card Co and IBF Financial Holdings Co., Ltd.

"The initiative, which is part of the FSC’s plan to foster innovation and financial inclusion, is credit negative for existing Taiwanese banks because the new competition risks driving down their profitability in the long run," analyst Sonny Hsu said in a report.

Also read: Malaysia rides on Asia's virtual banking drive

"The three new internet-only banks are likely to offer more attractive deposit rates to customers than incumbent banks because they can save on branch operating expenses and staff costs," said Hsu, adding that since deposit accounts at the internet-only banks will be covered by Taiwan's deposits insurance scheme, depositors may feel emboldened to transfer their funds to the new players.

Taiwan's banking system is historically fragmented, with the top five banks commanding just 36% of total system assets and below that of most Asian banking systems. A total of 38 banks compete to serve a population of 24 million, reflecting a fiercely competitive domestic landscape.

However, Moody's expects the combined total assets of internet-only banks to only amount to around 1% of total system assets provided they meet regulatory requirements.

Advertise

Advertise