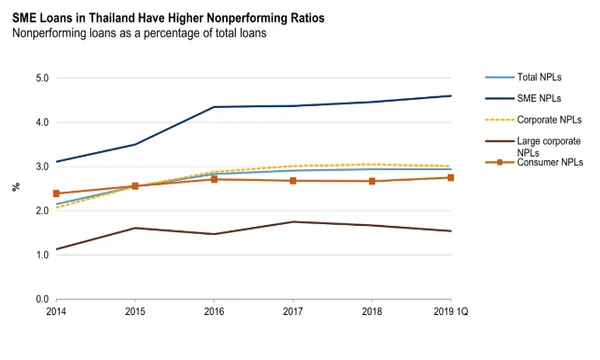

Chart of the Week: Thai banks' bad loan ratio hit 3% in Q1

SMEs’ bad loan ratio continued to grow from 4.4% to 4.6%.

Thailand banks’ non-performing loan (NPL) ratios hit around 3% in Q1, according to S&P Ratings. Small and medium-sized enterprises (SMEs) are still the main trigger as NPL ratio in the sector grew to 4.6% in Q1 2019 from 4.4% in 2017.

“Asset quality had been weakening since 2014 due to auto loans going bad, followed by loans to small to mid-sized enterprises (SMEs),” the ratings agency explained.

According to the report, the SME sector and low-income households continue to be weak, and did not benefit fully from the economic expansion. “There are also structural constraints at play, including high household debt and an ageing population that contributes to weak domestic consumption. Moreover, SMEs' vulnerability is partly also due to structural concerns and their limited ability to compete in a changing business environment,” it added.

Consumer NPL ratio has hit around 2.8% in Q1 whilst corporate and large corporate bad loan ratios were recorded at around 3% and 1.5% for the same quarter, respectively.

“Whilst NPLs in the household segment have been stable in recent quarters, housing loans (which account for half of consumer loans) continue to see a decline in asset quality. The NPL ratio for housing loans have risen to 3.35% as of March 2019, from 3.23% in 2017. Small business owners also take loans from banks in their personal capacity,” the ratings agency said.

The report further noted that an accommodative monetary policy in Thailand tempers the downside risk to NPLs in the housing sector. It added that Thai banks have been more stringent in their underwriting standards.

“The series of prudential measure on retail loans (credit card and personal loans followed by housing loans) taken by the central bank should also temper the downside risk. The property prices have not risen sharply refuting any indication of a widespread house price bubble,” the report said.

Advertise

Advertise