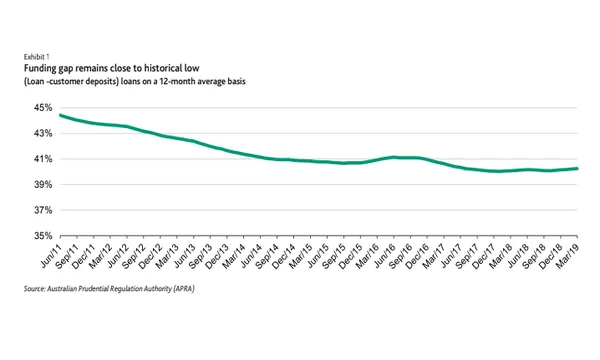

Australian banks grapple with funding gap's historic low of 40% in Q1

Investor loan growth slowed to less than 1%.

The funding gap of Australian banks, as measured by loans not funded by customer deposits, dropped to a historic low of about 40% in Q1, according to a Moody’s report.

Despite the stability of the funding gap for major and regional banks, the measure was widened by a group of small banks and foreign-owned banks operating in Australia, which in aggregate account for 18% of total assets in the banking system.

Meanwhile, deposit funding at the major banks' New Zealand operations increased as they maintained higher deposit-to-loan ratios than those of their parents’ operations.

Also read: Mortgage slowdown to hit Australian bank loans in 2019

“Pricing on deposits declined as slowing credit growth eased banks’ funding needs. Banks' wholesale issuance spreads for three-month tenors, and long-term bond issuance, decreased from previous highs,” the report said.

The moderation of housing loan growth drove a slowdown in overall credit growth. Investor loan growth slowed almost to zero in Q1, which was yet another historical low. Meanwhile, owner-occupier loan growth also eased to less than 6% in Q1 from about 8% as of Q3 2018.

“Tighter underwriting standards reduced the availability of credit, whilst declining housing prices weakened demand for credit, particularly from investors who are especially sensitive to expectations of capital losses and pre-election concerns of over potential tax changes,” Moody’s explained.

Business loan growth picked up, largely at the major banks and foreign-owned banks operating in Australia, reflecting their involvement in funding large businesses.

Advertise

Advertise