China's shadow banking assets fall to two-year low in Q1 even as crackdown eases

Core shadow banking activities have dropped to $420b in 2018.

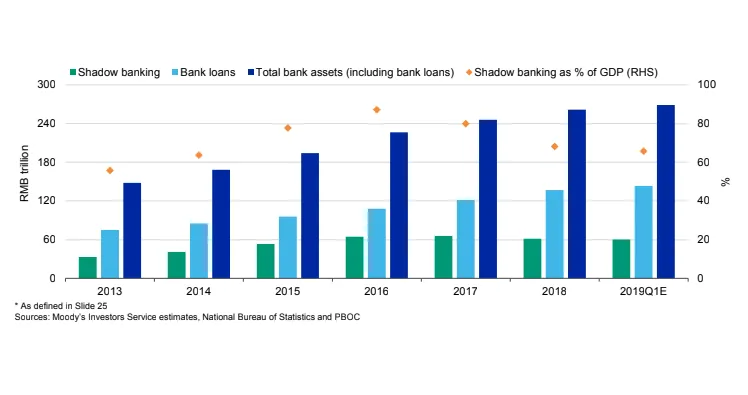

China’s deleveraging campaign has pushed broad shadow banking assets to its lowest level in more than two years, shrinking by nearly $170b (RMB1.2t) to $8.74t (RMB60.2t) in Q1, according to a Moody’s report.

As of March, core shadow banking assets were down 10.2% YoY, compared with a full year decline of 10.9% in 2018. Meanwhile, core shadow banking activities, which include trust loans, entrusted loans and undiscounted bankers’ acceptances, stabilised after a combined decline of $420b (RMB2.9 t) in 2018.

As a result of the crackdown, credit lines extended by banks have been issued through formal bank loans, with total new bank loans rising to a record high of around $1.16t (RMB8t) in the first five months of 2019, thanks to the shift in the authorities’ policy priorities towards sustaining growth.

Additionally, net shadow credit supply was largely flat in the first five months of 2019 from a year ago, whilst net new direct financing flows picked up marginally, supported by higher corporate bond financing.

Although the crackdown will support the long-term stability of the financial system, it will create funding challenges for small businesses that have long relied on shadow finance, prompting regulators to tone down the deleveraging campaign.

“The crackdown on shadow banking activities will continue to moderate during the remainder of 2019. Continued monetary and credit stimulus to support economic growth, combined with the increasing funding pressures being experienced by some small regional banks, are likely to make the authorities more cautious in their implementation of the financial de-risking campaign,” Moody’s said in its report.

Also read: China's shadow banking sector to shrink to half of GDP in 2019

“The easing of regulatory pressure on shadow banking, combined with increased bank lending, is leading to an increase in overall leverage. With nominal GDP growth remaining steady in the period, the faster pace of credit expansion led to an increase in economy-wide leverage,” Moody’s explained.

Also read: China to let up on shadow banking crackdown in 2019

An earlier report by Fitch ratings noted that China’s shadow banking assets is expected to contract to around half of nominal GDP by end-2019 from a peak of 70%. It was in 2017 when the country’s regulators intensified its crackdown on financial sector risk after observing a sharp rise in leverage brought about by banks turning to shadow banking set-ups to disguise non-standard lending activities.

Advertise

Advertise