Philippine banks conquer mounting bad loan risk

Corporates, which account for 76% of loans, have strong debt-servicing abilities.

Despite rising interest rates, Philippine banks will be able to maintain strong asset quality thanks to the debt servicing ability of corporates, Moody’s said in a report.

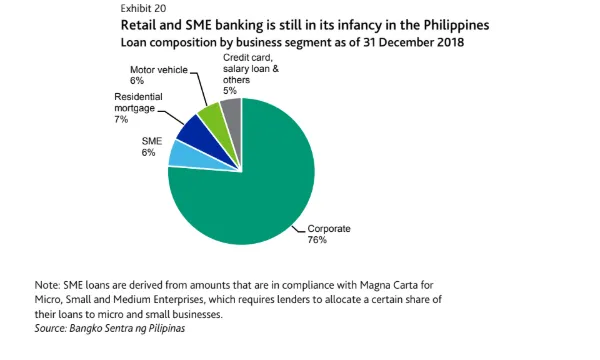

Corporate loans account for the lion's share of the banks’ lending portfolios at 76% with heavy concentration on a small number of conglomerates. Retail loan segments are left over the remaining 24% share with residential mortgages at 7%, SME loans (6%), motor vehicles (6%), credit card, salary loan & others (5%).

Also read: Bloated corporate loan books drag down Philippine banks

The agency noted that the country’s corporates are armed with sufficient income buffers to withstand the higher interest rates paired with the slowdown in their revenue growth. “Listed companies' interest coverage ratio has declined due to rises in interest rates but it still remained high at more than five times in 2018,” it added.

“Prior to rate hikes by [the] Bangko Sentral ng Pilipinas (BSP), systemwide asset quality improved steadily for years, helped by low interest rates and strong performance of the domestic economy,” Moody’s said in a report.

As of end-2018, the non-performing loan (NPL) ratio of corporates hover at a little above 1% compared to around 4% for consumer loans. The sector’s non-performing loan coverage has also consistently exceeded 100% and robust loan-loss reserves, signifying a strong buffer against potential defaults.

Also read: Philippine banks can weather their largest corporate default

Moreover, Moody’s also believes that the quality of retail loans will not deteriorate materially, noting that most retail loans are secured by residential properties and motor vehicles and originated at loan-to-value ratios of less than 80%, which will help mitigate any losses.

“However, in the longer term, efforts to increase loans to retail customers and small and medium-sized enterprises (SMEs) will lead to higher overall nonperforming loan (NPL) ratios, given that these loans are riskier than corporate loans,” Moody's warned, noting that lenders are trying to grow loans to households and SMEs to boost yields and diversify their exposure amidst the low credit penetration in the Philippines.

Advertise

Advertise