Japan's regional banks cash in on middle-risk loans

The share of real estate in total loans hit a record high 16%, thanks to regional lenders.

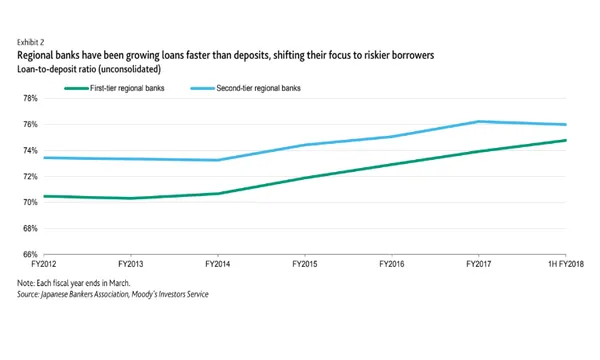

Regional banks in Japan have been boosting their exposure to firms with higher credit risks and to the real estate sector as they battle against declines in domestic loan yields, Moody’s said in a report. As a result, regional banks have been leading systemwide loan growth, boosting loans faster than deposits.

“Some regional banks' strategy is to boost what they classify as ‘middle-risk’ loans to small and medium-sized enterprises (SMEs) that rank on the lower end of creditworthiness,” the report said.

Also read: Here's where Japanese banks' shrinking loan balances are hitting harder

Moody’s noted that since FY 2016, real estate loans have accounted for about one third of the total loan growth at the system level, and their share in total loans climbed to a record 16% as of end March 2019, compared with a bubble-period high of 13% in the late 1990s. “Most of the growth has been at regional banks, which, during fiscal 2013-17, increased real estate loans at compound annual growth rates ranging from about 5% to more than 10%, compared with 0.4-3.4% for the megabanks,” the ratings agency explained.

Moreover, an increasingly large share of SME loans are real estate loans. Moody’s noted that in FY 2018, the growth contribution of real estate loans to SME loans increased to about 40%, whilst the growth rate of SME loans excluding real estate loans was similar to that of nominal GDP. Moody’s stated that real estate loans have been the fastest-growing segment in terms of sectors in recent years, although the pace is approaching a slowdown.

Meanwhile, Japan's three megabanks have been focusing on increasing overseas earnings, making them more insulated from domestic asset risks compared to their regional peers.

“Real estate loans, in particular, are vulnerable to a sharp drop in property prices, which in Japan is possible following a construction boom that defies population declines. A large increase in defaults on real estate loans would have a significant impact on overall asset quality, given that banks' loan books are now heavily concentrated on this segment,” Moody’s explained.

Advertise

Advertise