Which Asian banks have the freest credit line for POEs?

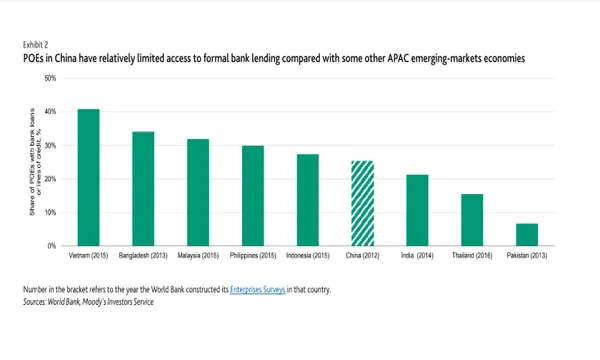

China is lagging behind with share of POE bank loans just at 26%.

Privately-owned enterprises (POEs) across Asia have trouble accessing formal bank lending although those in Vietnam enjoy the largest credit access as the share of POEs with bank loans in the Southeast Asian country stands at 41%, according to a Moody’s report. This is followed by Bangladesh at 34%, Malaysia (31%), Philippines (30%), and Indonesia (28%).

Notably, the share of POE bank loans in China are just 26%, highlighting the funding difficulties faced by the underserved sector. As part of efforts to boost funding access for POEs, China Banking and Insurance Regulatory Commission (CBIRC) aims to have new loans to POEs account for over a third of total new corporate loans for large commercial banks and more than two-thirds for medium-sized and commercial banks.

“Implicit and explicit government guarantees for the SOE sector are amongst the main factors that result in banks' strong bias in lending toward SOEs. In consequence, a large portion of credit supply flows to state-backed enterprises, including nonviable SOEs in industries with overcapacity,” Moody’s explained.

Another factor for the underserved POEs is limited transparency in the creditworthiness of private sector borrowers, according to Moody’s. “It exists in a particularly acute form in China because extensive implicit and explicit government guarantees for China's SOE sector tilt the playing field even more decisively against POEs.”

However, asset quality issues hound POEs in China as they are largely focused on cyclical sectors like manufacturing, real estate, wholesale and retail which makes them more vulnerable to China’s economic slowdown and escalating trade frictions. The sector’s non-performing loan (NPL) ratio stood at 4.2% and 4.7% in end-2017 which is significantly higher than the 1.7% for all commercial bank loans.

“POEs have had much higher default risks because of the government support available to SOEs [state-owned enterprises] and the banking sector is more comfortable in continuing to refinance SOEs' maturing debts,” Moody’s said in an earlier report.

Advertise

Advertise