Singapore bank NIMs up 3bps in Q1

UOB was the only weak link as margins shrunk 5bps.

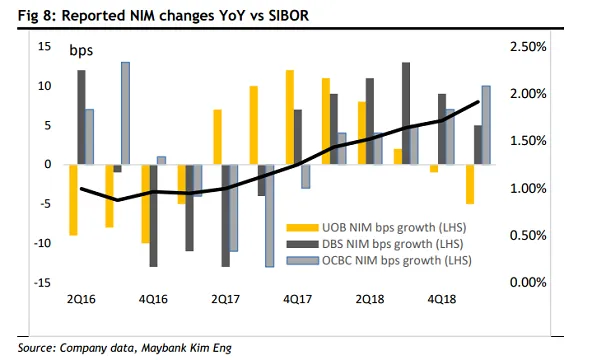

Singapore banks opened the year on strong financial footing as net interest margins, a common measure of profitability, improved 3bps YoY in Q1, according to Maybank Kim Eng.

Only UOB saw weaker margins as Q1 NIMs contracted 5bps to mark the second consecutive quarter of decline brought about primarily by excessive pre-funding of balance sheet liquidity with higher cost fixed deposits expanding 8.4% vs 5% for total deposits.

However, the worst may be over for the Lee-owned bank. "This trend is unlikely to be repeated and management claims that deposit growth has slowed down in 2Q19. As a result of retreating funding cost pressure, we believe UOB NIMs are at an inflection point," Thilan Wickramasinghe, analyst at Maybank Kim Eng said in a report.

Also read: Singapore bank NIMs set to widen to 1.98% in 2020

Without UOB, Q1 NIM’s for DBS and OCBC improved on 8bps YoY on average in Q1 as lending yields rose 44bps amidst re-priced board-rate-linked mortgages. All three banks pushed through one to two price escalations during the quarter which bodes well for their margins for the rest of the year.

"Indeed, the impact of these changes will linger for 2-3 quarters more as these loan price increases filter through to earnings," added Wickramasinghe.

Also read: Singapore bank loan growth to slow to 3% in 2019

Despite SIBOR increasing 48bps YoY, overall funding costs edged up by just 3bps YoY in what marks the slowest pace of growth in six quarters. There was an urgency by the banks, both domestic and foreign, to build balance-sheet liquidity and stay ahead of rising rates, but the trend seems to be easing as low-cost CASA deposit growth was flat and fixed and other higher-cost deposits grew 13% .

"With the US Fed guiding for a dovish outlook, we believe this trend will reverse and provide for more benign funding costs going forward. This should provide further upside support for spreads (+7bps 2018 – 2021E)," concluded Wickramasinghe.

Advertise

Advertise