Automation threatens one in three finance jobs: study

Remisiers, traders, and investment performance analysts are in the line of fire.

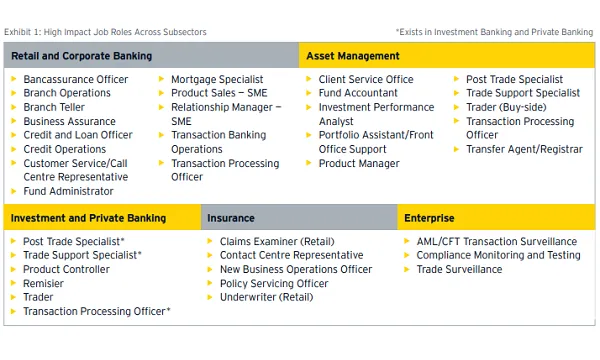

Of the 121 job roles in finance, 40 job roles could be highly impacted — with the potential for convergence or displacement — to automation, according to a study from the Monetary Authority of Singapore (MAS) and Institute of Banking and Finance (IBF).

“We have hypothesised that few job roles (if any) within financial services would be entirely displaced by automation, without the need for human oversight or intervention,” the joint study said.

Also read: Banks are at the forefront of Singapore's upskilling charge

MAS and IBF then conducted a study for six months to examine the impact of three technology trends: Robotic Process Automation (RPA), Advanced Analytics, and Artificial Intelligence (AI) across front office, mid-office, back office, and enterprise functions in the financial services industry in Singapore.

Posts in investment and private banking like remisier and trader as well as roles in asset management like investment performance analyst and post trade specialist are likely to get hit by automation, the study revealed.

A total of 54 job roles were examined across the banking sector, specifically retail, corporate, investment, and private banking. Middle and back office job roles are currently experiencing the greatest impact in terms of potential job convergence or displacement.

“Many enterprise job roles, especially those that are required to perform tasks such as data sourcing, in-depth analysis, and investigation are being augmented as a result of investments in data analytics and automation,” the study said.

Advertise

Advertise