Singapore bank loans grew 3.3% in February

However, consumer loans grew at the slowest pace since at least 2005.

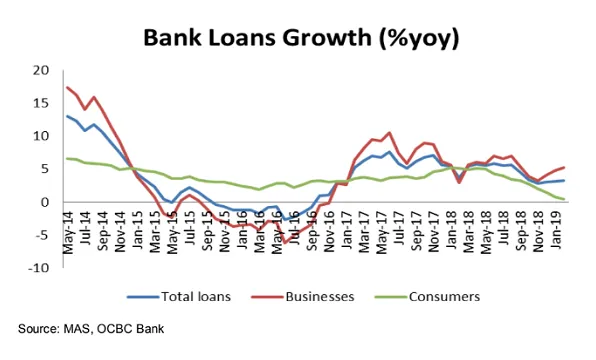

Singapore bank loans picked up pace after growing 3.3% YoY and 0.2% MoM in February from 3.2% in the previous month as gains from the corporate segment offset weakening activities in the consumer front, according to a report from OCBC Bank.

Also read: Property curbs and trade war are double whammy for Singapore banks

The headline loan growth figure represents the fastest pace of expansion since November 2018 when systemwide loans grew 2.8% and the highest since October when loan growth hit 3.4%.

In a breakdown, business loans rose 5.2% YoY and 0.4% MoM in February from 4.8% in the previous month. Although loans to the general commerce fell to 7.7% in February and loans to the building and construction sector slowed to 12.7%, loans to financial institutions hit a five-month high of 3.3%.

"Under Budget 2019, the government had earlier announced that it will increase the accessibility of loan financing for firms by taking up to 70% of the risk (up from 50%) for firms, and this may provide some support for business bank loans going forward," analyst Selena Ling said in a report.

On the consumer front, however, the picture looks much dimmer as loan growth ground to a halt at 0.5% in February from -0.2% MoM the previous month, which represents the slowest pace of expansion since at least 2005. The figure is even lower than the 1.4% growth seen in May 2006 or the cycle low before the Global Financial Crisis.

Also read: Singapore banks' loan growth to grind to a halt at 0.5% by end-2019

Housing and bridging loans eased to 1.2% in February from 1.6% and the private housing market is likely to remain subdued following property cooling measures and expectations of higher rates.

"Our full year 2019 bank loans growth forecast is 1.6% yoy, which suggests there is downside risk of slower bank loans momentum for the months ahead. This will likely be a moderation from the average 4.7% yoy pace seen in 2018 and could potentially mark the weakest year for bank loans growth since the -0.7% yoy decline in 2016," added Ling.

Advertise

Advertise