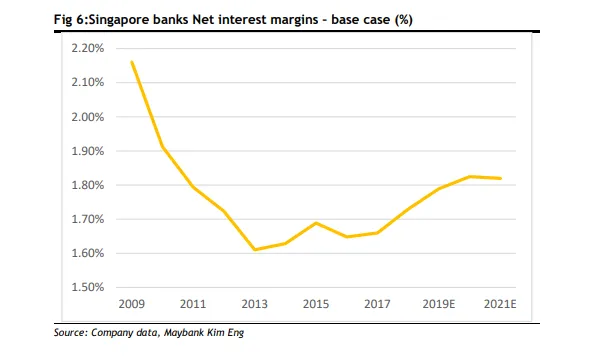

Singapore bank NIMs to widen despite rising costs

SIBOR has risen 6bps YTD and is expected to rise further.

The net interest margins (NIM) of domestic Singapore banks are expected to widen despite rising costs, Maybank Kim Eng said.

SIBOR has increased 6bps YTD to extend a 63bps rise in 2018, a trend which will likely continue into 2019 as some bank deposit liquidity gets diverted to Singapore Savings Bonds and MAS maintains its current SGD appreciation policy. “Last year, funding costs for the sector rose 35bps YoY. We estimate this will more than double in 2019,“ said Maybank KE analyst Thilan Wickramasinghe.

The firm forecasts a 76bps increase in funding costs for the sector in 2019E.

Also read: Singapore bank NIMs set to widen to 1.98% in 2020

However, banks with high loan to deposits (LD) and smaller low-cost deposits mix should see downside NIM pressure, the analyst noted. “This will affect mostly the foreign banks, in our view. Domestic banks, with lower LD ratios and a higher mix of low-cost deposits, should see NIMs rise further."

Maybank KE found that about 1.88-2.05% is on offer for promotional fixed deposits by Singapore banks, which is still lower compared to yields of sovereign guaranteed SSB Retail bonds at 2-3%. The bonds’ issuances rose from 7% in 2015 to 12% in 2018.

“Customers diverting deposits to SSBs heightens funding competition which will drive up costs. With the individual SSB investment limit doubled to $200,000 from February 2019, the pace of diversion may accelerate,” Wickramasinghe said.

Separately, MAS’ current SGD appreciation policy – which has also contributed to driving up SIBOR – is unlikely to change in their April policy meeting, according to Maybank KE. “Whilst system LD ratio has fallen to 105% in January 2019 from a recent peak of 110% in June 2018, as a result of slower loan growth, this alone is unlikely to mitigate overall system funding pressure."

Advertise

Advertise