Hong Kong banks' 2019 loan growth cut to 2% as trade and mortgage loans take hit

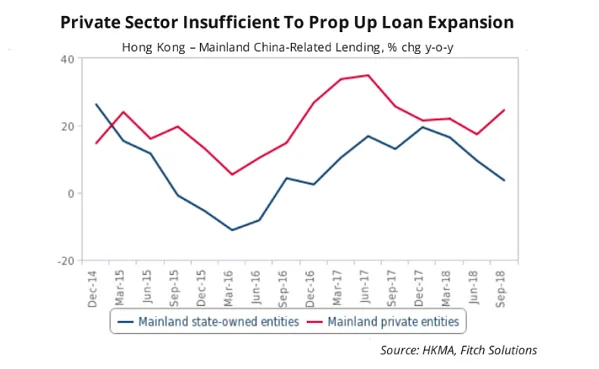

Lending to Mainland firms has been trending downwards to 6.1% in September 2018.

Banks in Hong Kong will continue to face difficulty in growing their loan books as loan growth is expected to fall to 2% in 2019 from 5% in 2018, according to Fitch Solutions.

Also read: Banks in Hong Kong make do with falling loan growth as earnings lifeline

Commercial bank loan growth has fallen sharply to 5.2% in November 2018 from 16.8% in November 2017 as the ongoing trade dispute and the slowing Chinese economy weighed in on Mainland borrowing activities, particularly trade-related loans.

In fact, loans use to finance imports to, exports and re-exports from Hong Kong contracted 6% in November to record the fastest pace of contraction since August 2016, data from the Hong Kong Monetary Authority (HKMA) show.

“This will likely be compounded by the continued slowing of the electronics sector amid the woes facing Apple Inc, which will act as a drag to Hong Kong’s re-exports to China (accounting for 50% of total exports),” Fitch Solutions said in a report.

Sustained lending to the private sector, which rose from 21.5% in December 2017 to 24.6% in September 2018, also proved inadequate to prop up commercial loan expansion. This comes as banks held back from lending to Mainland Chinese firms as loan growth has crashed to 6.1% from 17.5% over the same period.

The weakening housing market is also proving to be a bane for banks’ loan growth, particularly with regards to mortgages and home development loans.

“Weakening property demand is likely to weigh on residential mortgages, and the expansion of 9.1% y-o-y as of October 2018 (versus 8.1% y-o-y a year ago) is likely to wane,” added Fitch Solutions. “Loans headed towards residential property development remains at a weak rate of 2.7% YoY in September 2018, well below the highs of 24.8% YoY.”

Advertise

Advertise