Hong Kong banks make do with falling loan growth as earnings lifeline

Gains from Chinese business will remain limited.

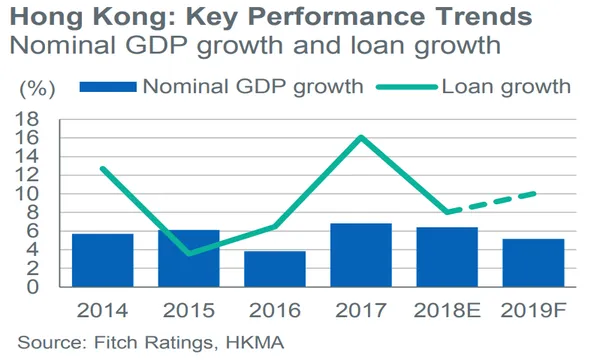

Banks in Hong Kong will have no choice but to make do with dismal loan growth as their main earnings driver for 2019, according to a report from Fitch Ratings, as increasingly tough market conditions are expected to weigh heavily on banking profitability.

"Rising interest rates and uncertainty around corporate investment and trade activity could tip a shift in domestic sentiment, leading to softer property markets and slower cross-border loan demand," the firm said in a note.

Also read: Close Chinese ties raise Hong Kong banks' compliance risk

Bank loan growth has already declined for the fourth consecutive month in October as the combination of deepening US-China trade tensions, ongoing stock market rout and weaker housing loan demand dragged borrowing activities.

Loan demand is expected to slow to a measly 3% by December from a strong 9.5% in July, according to OCBC Treasury Research.

Fitch Ratings added that stiff competition will limit gains from wider spreads on Chinese-related operations and consequently exert pressure on funding costs that would have otherwise lent support to bank earnings.

Also read: What are the key risks to buoyant Hong Kong banks?

The branches and subsidiaries of Mainland-owned banks in Hong Kong accounted for 38% of system assets and deposits by end-2017, up from 32% five years ago.

“[R]ising competition in the local market could largely offset these positive trends, particularly for smaller banks, whilst there is a risk that banks shift into higher-yielding assets to support their margins,” Fitch Ratings said in a previous report.

However, key metrics will likely remain stable although liquidity and asset quality could weaken slightly in 2019.

Advertise

Advertise