Chinese bank loan growth to hit 13.8% in 2019

The non-financial corporate segment will drive lending gains.

The loan growth of Chinese commercial banks is expected to hit 13.2% by end-2018 and 13.8% in 2019 as the government continues to chart a looser monetary policy in order to cushion the economic slowdown, according to Fitch Solutions.

Fitch Solutions expects the central bank to continue cutting the reserve requirement ratio and inject liquidity through policy tools and medium-term lending facility and pledged supplementary lending in order to support credit-short businesses who have been bearing the brunt of the deleveraging programme.

Also read: Chinese banks new loans hit $199.05b in September

“We expect easier monetary policy, coupled with the government’s push to encourage financial institutions to make lending to small businesses a part of their internal performance evaluations, to spur greater lending to these companies,” the firm said in a report, adding that city-level and rural-level commercial banks will continue to play a bigger role in disbursing credit to small businesses.

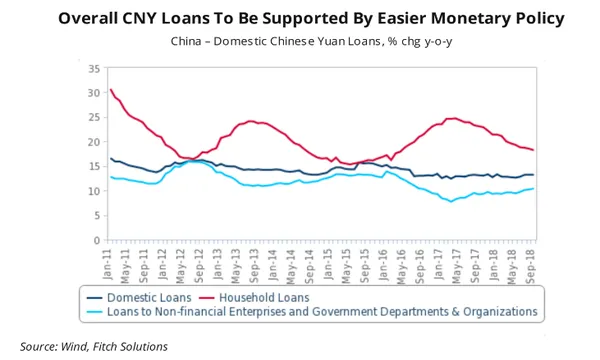

Domestic Chinese yuan loans have already been expanding at a faster pace than total social financing (TSF) in January-October after coming in at 13% in October versus the latter’s 10.2%.

The growth momentum is expected to continue over the coming months as the People’s Bank of China ensures sufficient liquidity to Chinese non-financial corporates.

Also read: China urges banks to ramp up government bond purchases

On the other hand, household loan growth is expected to extend continue a downward trend that started in Q2 2017 amidst growing concerns in household debt which rose to 49.3% of GDP in Q1 2018 from 18.8% of GDP ten years ago.

“Short-term household loan growth is therefore likely to moderate from the strong expansion of 20.3% y-o-y seen in October 2018 (which has maintained at around this pace for the past year),” the firm added.

Advertise

Advertise