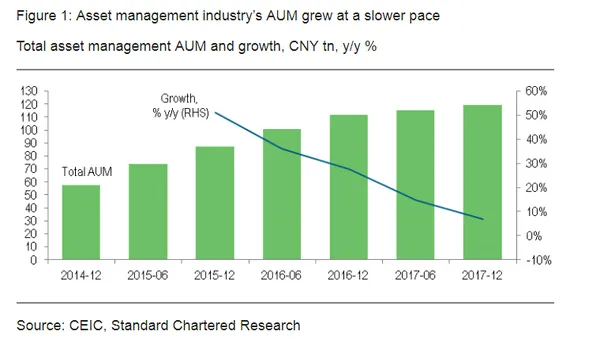

Chart of the Week: Check out the growth of AUM held by China's asset management industry

Assets under management exceeded $15.69t.

China's financial regulators released the final version of the new guidelines to rein in the growth in the country's asset management industry as assets under management (AUM) in that segment easily exceeded the $15.69t (CNY100t) mark which represents over 120% of the GDP, according to Standard Chartered.

The guidelines tackle implicit guarantees, capital-asset pooling, investment in non-standard credit assets (NSCAs), over-leverage and channel businesses to bring the business in line with international standards and reduce room for regulatory arbitrage.

Several adjustments were made to the final version, based on feedback on the draft: extension of the transition period by 18 months to end-2020; allowing the amortised cost method to be used in valuing certain financial assets; and adoption of stricter criteria in identifying standard credit assets and qualified investors.

"With some shadow-banking business moving back onto banks’ balance sheets, the industry’s AUM may now grow at a slower pace, while pressure may build for banks to beef up their capital base. The restrictions on channel businesses and capital-asset pooling will likely constrain growth of non-bank financial institutions. With investment in NSCAs subject to tighter regulation, demand for standard credit assets may increase," Standard Chartered noted.

China’s banking system assets plunged from 16.5% in 2016 to 8.7% in 2017 to represent the first drop to single-digit growth in more than a decade, reflecting the ongoing transition of banks to on-balance-sheet activities like loans.

Loan growth clocked in at a steady 12.1% which makes last year the first year since 2013 that loan growth has outpaced asset growth. The welcome development comes as China intensifies its shadow banking crackdown as regulators step up oversight and incorporating related rules in their Macro Prudential Assessment (MPA).

Also read: Here's how China's shadow banking crackdown hit assets for JSCBs and RCCBs in 2017

The People’s Bank of China may cut the required reserve ratio further to keep liquidity stable, the bank added.

Advertise

Advertise