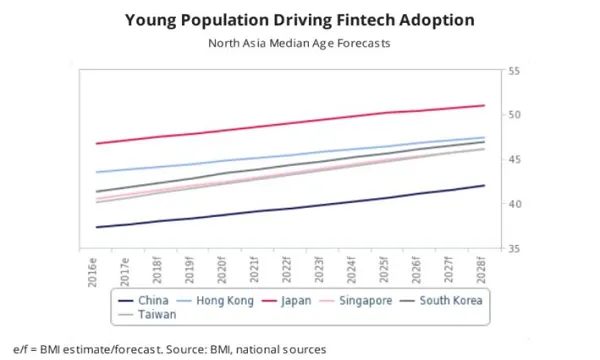

Chart of the Week: Here's how the younger generation in China pushes fintech growth

They are likely to help the continued penetration and popularity of e-payment systems.

The relatively younger population and China's poor banking infrastructure will support the continued penetration and popularity of e-payment systems, BMI Research reports, saying that this is the main driver for fintech growth in China.

Here's more from BMI Research:

Compared to its regional peers, China has a considerably younger population which has demonstrated its willingness to embrace new technology. With the younger generation more likely to be receptive of new products, this has resulted in e-payment systems having a higher take up rate in China compared to Hong Kong and Japan. China's large population also provides critical mass, which is necessary for the widespread implementation of e-payment systems.

Lastly, China's younger generation is more likely to be less bound to traditions compared to more established societies in the region, with the younger generation having grown up as China was opening up in the late 1990s and early 2000s. This suggests that they are more willing to experiment with other payment methods, with mobile wallets being viewed as a more convenient way to transfer cash.

The push towards a cashless society also appears to be spearheaded by the younger generation, where apps such as WeChat are used to transfer money as wedding gifts and to pay for food in restaurants. We believe that this trend is likely to continue as China’s population ages more slowly than its peers and forecast the 15-29 years to account for 16.7% of the population in 2027 in contrast to an average of the regional average of 14.8%.

In addition, China will continue to have the highest youth population in North Asia (23.6% of total) in 2027, standing considerably above the regional average of 21.3%.

Advertise

Advertise