Chart of the Week: Check out how Thai consumers are turning to digital banking services

Mobile and internet banking accounted for 33% of total payment transactions for 9M 2017.

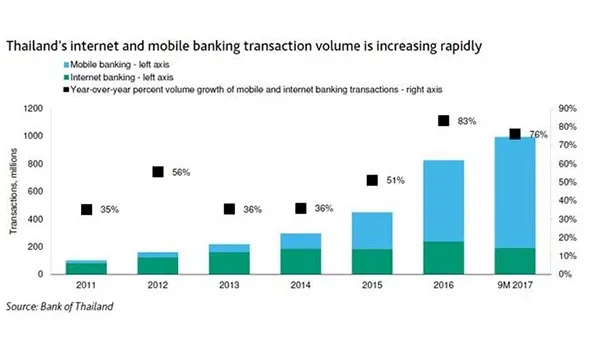

Thai consumers are increasingly adopting digital banking transactions amidst an improvement in internet and mobile penetration as mobile and internet banking grew 8% since 2010 to account for over a third (33%) of of total payment transaction volume for the first nine months of 2017, according to credit agency Moody's.

In value terms, mobile and internet banking accounted for a whopping $747.63b (THB23.4t) in the first nine months of 2017 which represents a 22% compounded annual increase in value over the same period.

Here's more from Moody's:

Thailand’s increased usage of digital banking channels since 2015 reflects banks’ increasing focus on digital strategies. Kasikornbank Public Company Limited (KBank, Baa1 stable, baa21 ) in 2014 began investing around THB480 million annually to enhance its digital banking services. As of year-end 2017, KBank had 7.3 million users on its mobile banking channel, recording around 3 billion transactions during the year, a tenfold increase from 2014. This year, Bank of Ayudhya (BAY, Baa1 stable, ba1) said that it would invest THB20 billion to develop its technology infrastructure and digital banking platform. Siam Commercial Bank Public Company Limited (SCB, Baa1 stable, baa2) last year planned to invest THB40 billion to enhance its digital banking capability. We expect the volume of digital banking channel transactions to continue increasing.

The shift to online transactions provides Thai banks an opportunity to rationalize their branch networks, thereby extracting operational cost efficiencies. Exhibit 3 shows the number of commercial bank branches decreasing to 6,826 as of 30 September 2017 from a peak of 7,061 branches as of 30 December 2015. Concomitantly, the banks’ annualized cost-to-income ratios declined to less than 52% as of the end of September 2017 from 54% in 2015. In January, SCB announced plans to reduce its traditional branches to 400 from 1,153 by 2020, while BAY said it will transform half of its traditional branches into digital or hybrid-digital platforms. BAY expects its investment in IT to result in a 10%-15% decline in operating costs over the next three years.

Widespread use of digital banking channels also will allow Thai banks to gradually expand their products beyond current transactional products and increase interest income. This will counteract the risk that charges on digital banking channels likely will fall because of competition. Some banks have started to offer loans through their digital banking channels. For example, KBank this year launched its K-Personal Loan service, which calculates interest rates by considering each individual customer’s risk factors to offer customized loan products via its mobile banking application, and SCB aims to make THB10 billion in retail loans through its mobile banking application this year.

Advertise

Advertise