In Focus

Singapore banks' aggregate operating income to slow to 5% in 2016

But core net profit can grow 7%.

Singapore banks' aggregate operating income to slow to 5% in 2016

But core net profit can grow 7%.

All eyes on credit quality as Indonesia’s banks bank on surging economy for growth

Banks are expected to grow an anemic 13%.

Japanese mega banks' earnings dampened by regional exposure

Profit dropped in the past months.

Asset quality in Indonesia and Malaysia most likely to deteriorate

But other ASEAN banks are in a better position.

Are Singapore banks breaking free from decaying asset quality soon?

Banks showed resilience in the face of volatility.

Singapore's system loans slip 0.8% in September as DBU and ACU disappoint

Overall corporate loans declined 1.1%.

Deposit cap removal a bellwether for full interest-rate liberalisation in China

Chinese banks will remain highly influenced by policy directives.

Are Singapore banks doomed for another full-blown crisis soon?

Don’t count on a results rebound.

Debt threat: Indonesian banks' profits pressured by rising bad debts and slowing economy

Bank Negara Indonesia's gross NPL ratio rose to 2.8% for the first nine months of 2015.

Banks lose out in cybersecurity

The rising sophistication of digital attacks means that banks must employ new measures.

China's TSF rebound in September offset by domestic FX loans' fastest decline since 2002

Total social financing amounted to RMB1.3tn.

Don't get your hopes up unless Singapore banks' NIMs expand by 30bps or more

An increase of 10bps has no significant effect on net profit.

More than 50% of the population across emerging Asia still unbanked

But financial inclusion in emerging Asia has visibly progressed since 2011.

Regulatory traps stall Singapore banks’ expansion

Greater regional exposure also comes with increased regulatory complexities.

Thai banks' interest income drops for 3 consecutive quarters

It fell by 1.2% in Q215, worsening from -0.8% in Q115.

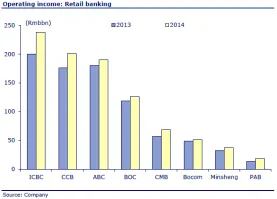

Who's winning China's retail banking race?

The top bank raked in RMB238 billion in 2014.

Don't be fooled by Malaysia's strong business loan growth

The 10.2% growth could merely be a sign of cash flow constraints from operational bottlenecks.

Advertise

Advertise