Chart of the Week: How are ASEAN banks deploying real-time payment systems?

They are shunning in-house developments and vendor solutions.

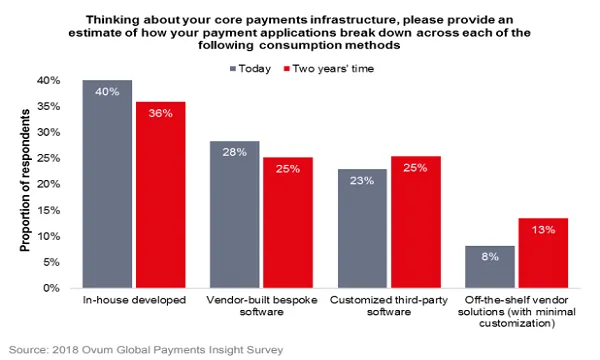

Banks in the ASEAN region are shifting to off-the-shelf vendor solutions to produce their digital payments infrastructure as in-house developments are expected to fall from 40% to 36% of payment applications, and bespoke from 28% to 25% over the next two years, according to a report from ACI Worldwide.

The report noted that the shift is part of regional banks cost reduction and simplification strategies which actually runs in contrast with global figures that reflect a growing preference for in-house developments after rising from 37% to 39%.

"Increasingly, these will be replaced by customized third-party software and off-the-shelf vendor solutions with minimum customization and maintenance requirements. ASEAN banks expect the use of off-the shelf systems with configuration builder toolkits such that future enhancements can be done through configuration rather than customization, to increase from 8% to 13%, bringing them into line with global usage, where such solutions currently represent 12% of usage and are also expected to increase to 13% over the same period," the report added.

Advertise

Advertise