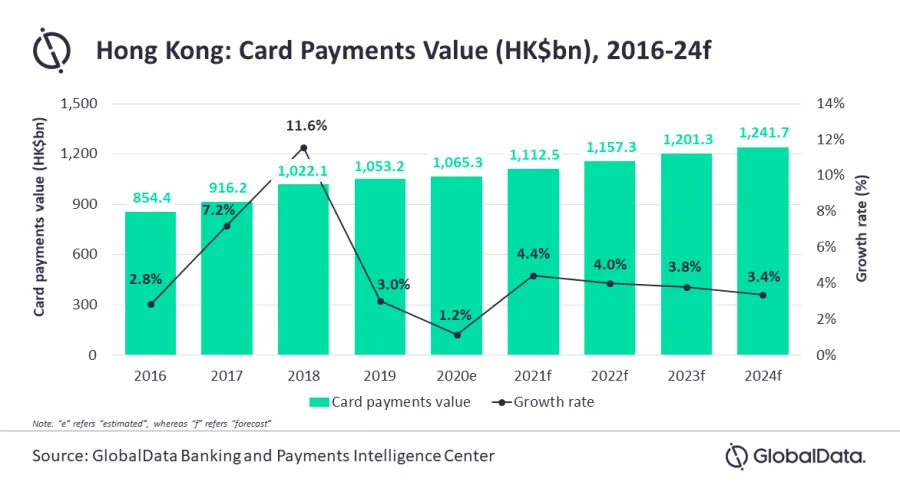

Chart of the Week: Hong Kong card payments value to grow 4.4% in 2021

This comes after two years of decelerating growth due to trade tensions, protests, and the pandemic.

Hong Kong’s card payments market is expected to rebound in 2021 as the local economy gradually recovers to grow 4.4% in 2021 and reach US$143.5b (HK$1.11t) in value, reports data and analytics company GlobalData.

The value of card payments in the city grew by a marginal 1.2% in 2020 as consumer spending declined amidst the pandemic. The market is expected to revive this year as businesses gradually reopen, consumer spending rises, and travel restrictions are lifted, along with the launch of the COVID-19 vaccination program.

The acceleration of card payments’ growth comes after two years of deceleration. Even before the pandemic struck, growth has been hampered by the US-China trade war followed by the Hong Kong protests, notes Ravi Sharma, lead banking and payments analyst at GlobalData.

“The payment card market in Hong Kong is mature with high card penetration of 3.4 cards per inhabitant. It also has a high annual spending per card driven by its robust payment infrastructure. Despite this, the market growth decelerated in the past two years due to the global trade war followed by Hong Kong protests (anti-extradition law movement) which affected the country’s economy. This was further worsened by the COVID-19 crisis, affecting card payment growth,” he noted.

With COVID-19 restrictions now being eased and consumer spending on rise, both debit and credit cards use is expected to increase.

GlobalData’s Payment Cards Analytics reveals that the value of credit and charge cards payment is set to grow by 5.0% in 2021 while debit cards will grow by 3.3% during the same period.

Growth is expected to continue beyond 2021 barring any further disruptions, with the value of card payments is forecasted to register a compound annual growth rate (CAGR) of 3.7% to reach$160.1b (HK$1.24t) in 2024.

Advertise

Advertise