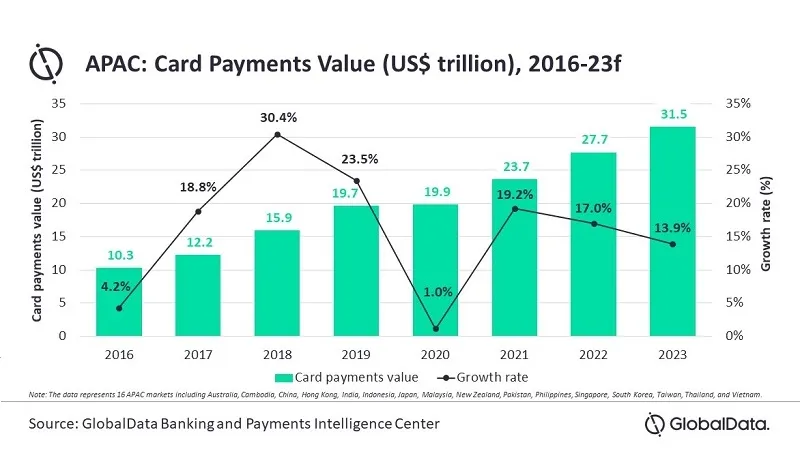

Chart of the Week: APAC card payments to grow 19.2% in 2021

Banks and payment firms are stepping up their card game to encourage cashless spending.

Card payments in Asia-Pacific region are set to strongly rebound in 2021 and grow by double digits following muted growth in the previous year, forecasts data and analytics company GlobalData said.

According to GlobalData’s estimates, APAC’s overall card payments will grow by 19.2% in 2021, from only a 1% growth in 2020.

Last year’s weak numbers resulted from reduced consumer spending amidst the COVID-19 pandemic, says Nikhil Reddy, banking and payments analyst at GlobalData.

“Several APAC countries implemented strict lockdown measures and travel restrictions to contain COVID-19 pandemic. This resulted in decline in consumer spending and impacted card payments growth in the region,” Reddy noted.

With government restrictions being lifted and vaccine distribution gathering pace, economic activities are gradually resuming.

APAC countries are notedly now set to witness faster recovery compared to their Western counterparts, according to the International Monetary Fund (IMF) forecasts released in January 2021. In particular, China is expected to grow by 8.1% whilst India’s growth is pegged at 11.5% in 2021.

In their earlier released report on payment cards, GlobalData posits that card payments are expected to grow at a compound annual growth rate (CAGR) of 15.4% between 2021 and 2023 to reach US$31.5t in 2023.

Government initiatives will play a key role in pushing card usage in the region by abolishing merchant fees and increasing limits. For instance, India abolished merchant service fee on state-owned RuPay cards. Several countries have also increased the limit on contactless payments to encourage shift away from cash and towards cards for small value purchases.

But whilst card penetration is on the rise in Asia, point-of-sales penetration remains very low as small businesses are reluctant to install POS due to their associated costs. As an example, India only has POS penetration of 4.1 per 1,000 individuals in 2020, compared to 46.6 in the United Kingdom.

However, payment companies have stepped up their game and are now offering low-cast POS devices to make card acceptance more affordable especially to small and medium enterprises, which comprise a large number of local businesses in Asian countries.

For instance, in June 2020 Malaysia-based Hong Leong Bank launched Cashless Lagi Senang campaign, which offered merchants low-cost POS terminals without monthly rental, setup fees and security deposit, noted GlobalData.

The usage of payment cards is also now being extended for transit and toll payments, which is further supporting its growth. As an example, in January 2021, Bangkok Expressway and Metro in Thailand installed contactless readers at toll plazas.

The rise of e-commerce have also supported card payments. The increased interest in online shopping is driving banks to aggressively promote card usage by offering various rewards to customers.

Furthermore, the proliferation of digital-only/challenger banks is pushing bank penetration in the region helping card usage. There are over 40 such banks now operating in the region, according to GlobalData.

Advertise

Advertise