CTBC Bank PH unveils redesigned web interface and mobile banking app

The app features personalised widgets and customisable features.

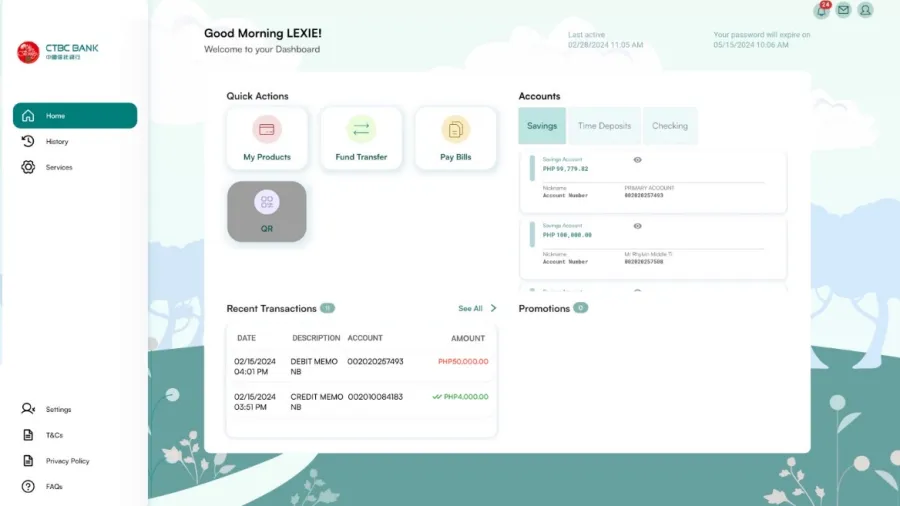

CTBC Bank Philippines has redesigned its web interface and mobile banking applications for its retail clients.

Developed in partnership with Hitachi Asia, the redesigned Retail NetBanking app features a more unified dashboard, simplifying navigation, functionally, and user experience, CTBC Bank Philippines said in a press release.

The app now features personalised widgets and customisable features.

ALSO READ: PH banks’ total assets expanded 9.2% to $439.3b in 2023

The Retail NetBanking app also integrates a suite of advanced security measures to safeguard user data. In addition to requiring the input of User ID and password, a time-based one-time password (OTP) system is introduced to fortify defences against unauthorized access. A secure socket layer (SSL) encryption creates a secure and encrypted link between the user's device and the banking servers.

CTBC Bank Philippines said that it will introduce even more security features in the future, including biometric authentication for transaction.

Advertise

Advertise